US Federal Reserve Cuts Key Rate for 2nd Time This Year

Voice of America

19 Sep 2019, 02:05 GMT+10

WASHINGTON - A sharply divided Federal Reserve cut its benchmark interest rate Wednesday for a second time this year while saying it's prepared to continue doing what it deems necessary to sustain the U.S. economic expansion.

The Fed's move will reduce its benchmark rate - which influences many consumer and business loans - by an additional quarter-point to a range of 1.75% to 2%.

The action was approved 7-3, with two officials preferring to keep rates unchanged and one arguing for a bigger half-point cut. It was the most Fed dissents in three years.

The divisions on the policy committee underscored the challenges confronting Chairman Jerome Powell in guiding the Fed at time of high uncertainty in the U.S. economy.

The economic expansion appears durable in its 11th year of growth, with a still-solid job market and steady consumer spending. But the Fed is trying to combat threats including uncertainties caused by President Donald Trump's trade war with China, slower global growth and a slump in American manufacturing. The Fed notes in a policy statement that "business fixed investment and exports have weakened."

Still, the Fed's modest rate cut irritated Trump, who has attacked the central bank and insisted that it slash rates more aggressively. The president immediately signaled his discontent:

"Jay Powell and the Federal Reserve Fail Again," Trump tweeted. "No `guts,' no sense, no vision! A terrible communicator!"

Updated economic and interest rate forecasts issued Wednesday by the Fed show that seven of 17 officials foresee one additional rate cut this year, rather than the two or more that many investors have been expecting. The outlook becomes hazier in 2020: At least two Fed officials expect a rate hike next year.

None of the policymakers foresee rates falling below 1.5% in 2020 - a sign that the turbulence from a global slowdown and Trump's escalation of the trade war is viewed as manageable.

The median forecasts show the economy is expected to grow a modest 2.2% this year, 2% next year and 1.9% in 2021. Those forecasts are well below the Trump administration's projection that the president's policies will accelerate growth to 3% annually or better. But they also suggest that policymakers do not envision a recession.

Unemployment is projected to be 3.7% and inflation 1.5%, below the Fed's target level of 2%.

Most economists have scaled back their forecasts for further rate cuts this year to one or two beginning with the one the Fed announced Wednesday. A resumption of trade talks between the Trump administration and Beijing and a less antagonistic tone between the two sides have supported that view.

So has a belief that oil prices will remain elevated, that inflation might finally be reaching the Fed's target level and that there are increasing signs that the U.S. economy remains sturdy. The job market looks solid, wages are rising, consumers are still spending and even such sluggish sectors as manufacturing and construction have shown signs of rebounding.

Yet no one, perhaps not even the Fed, is sure of how interest rate policy will unfold in coming months. Too many uncertainties exist, notably the outcome of Trump's trade war.

Trump has meantime kept up a stream of public attacks on the central bank's policymaking, including referring to Powell as an "enemy" and the Fed's policymakers as "boneheads." Even though the economy looks resilient, the president has insisted that the Fed slash its benchmark rate more deeply - even to below zero, as the European Central Bank has done - part to weaken the U.S. dollar and make American exports more competitive.

No one expects the Fed to go anywhere near that far. Powell has said that the policymakers remain focused on sustaining the expansion and keeping prices stable without regard to any outside pressures.

At a news conference Powell is holding Wednesday, he will likely be asked about the risks facing the economy, including the attacks on Saudi oil production facilities, which sent oil prices surging and could raise inflation expectations.

The Fed is also monitoring the global slowdown, especially in Europe, and Britain's effort to leave the European Union. A disruptive Brexit could destabilize not just Europe but the U.S. economy, too

U.S. inflation, which has long been dormant, has begun to show signs that it is reaching the Fed's 2 percent target and might remain there. If the Fed's policymakers conclude that inflation will sustain a faster pace, it might give them pause about cutting rates much further.

The most serious threat to the expansion is widely seen as Trump's trade war. The increased import taxes he has imposed on goods from China and Europe - and the counter-tariffs other nations have applied to U.S. exports - have hurt many American companies and paralyzed their plans for investment and expansion.

In recent days, the Trump administration and Beijing have acted to de-escalate tensions before a new round of trade talks planned for October in Washington. Yet most analysts foresee no significant agreement emerging this fall in the conflict, which is fundamentally over Beijing's aggressive drive to supplant America's technological dominance.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Peking Press news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Peking Press.

More InformationBusiness

SectionMcDonald’s to shut down CosMc’s drink spinoff after short run

CHICAGO, Illinois: McDonald's is closing its experimental beverage spinoff, CosMc's, less than two years after launching the standalone...

China’s Lenovo profit plunges 64%, misses estimates sharply

BEIJING, China: China's Lenovo reported a steep 64 percent drop in fourth-quarter profit, falling significantly short of analyst expectations...

Economic data gives welcome relief to Wall Street

NEW YORK, New York - Strong economic data jump-started U.S. stocks and the dollar Tuesday, a welcome reprieve after weeks of pressure...

PepsiCo cleared in FTC case over Walmart discounts

NEW YORK CITY, New York: This week, the U.S. Federal Trade Commission (FTC) dropped its lawsuit against PepsiCo, which had accused...

Builder discounts drive sales spike, but housing outlook wary

WASHINGTON, D.C.: New single-family home sales in the U.S. rose sharply in April to their highest level in over three years as builders...

CEO says health push weakened Nestle, vows return to F&B roots

VEVEY, Switzerland: Nestle is realigning its focus on its core food and beverage operations after expanding into areas like health...

China

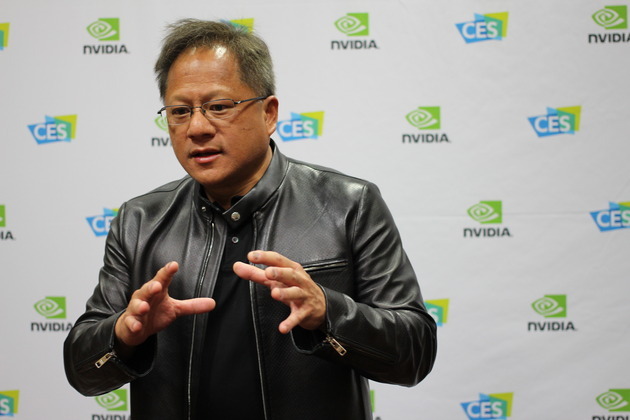

SectionNvidia targets China’s data market with new AI chip

BEIJING/TAIPEI: Facing mounting U.S. export restrictions, Nvidia is preparing to launch a new, lower-cost artificial intelligence chip...

China’s Lenovo profit plunges 64%, misses estimates sharply

BEIJING, China: China's Lenovo reported a steep 64 percent drop in fourth-quarter profit, falling significantly short of analyst expectations...

Foreign students at Harvard bear the brunt of White House ban

BOSTON, Massachusetts: U.S. President Donald Trump's administration has taken away Harvard University's right to enroll international...

Aussie firms upbeat on China outlook despite trade tensions

SYDNEY, Australia: Australian businesses are feeling optimistic about their prospects in China despite escalating global trade tensions,...

Russia’s top oil company takes over largest rare earth deposit

MOSCOW, Russia: Russia's top oil company, Rosneft, has taken over control of the country's largest rare earth metals deposit, Tomtor,...

Indian envoy to China pays tribute to Indian soldiers who defended Hong Kong in World War I

New Delhi [India], May 28 (ANI): Indian Ambassador to China, Pradeep Kumar Rawat on Wednesday laid a wreath at the Indian Soldiers'...